The auction calendar is part of the public debt policy outlined in the Annual Borrowing Plan for 2017(ABP 2017)[1], which is consistent both with the multi-year fiscal consolidation strategy and the Economic Program approved by the Congress for the fiscal year of 2017.

In this context, public debt policy for 2017 is designed to strengthen macroeconomic fundamentals through an efficient public debt management of the Federal Government’s debt portfolio. In this regard, the following stand out:

- Consistent with the fiscal consolidation strategy, the public debt policy seeks to meet the Federal Government's financing needs at reduced costs, with a long-term horizon and low level of risk.

- The MoF plans to meet the Federal Government’s financing needs primarily through local debt markets.

- Actions regarding public debt management are oriented towards improving the efficiency of the Federal Government’s debt portfolio. In this regard, the MoF will carry out liability management transactions on a regular basis with the aim of improving the maturity profile of the portfolio and to adapt it to prevailing market conditions.

In summary, the Federal Government's public debt policy will follow a proactive and flexible strategy to strengthen public finances and Mexico’s macroeconomic fundamentals.

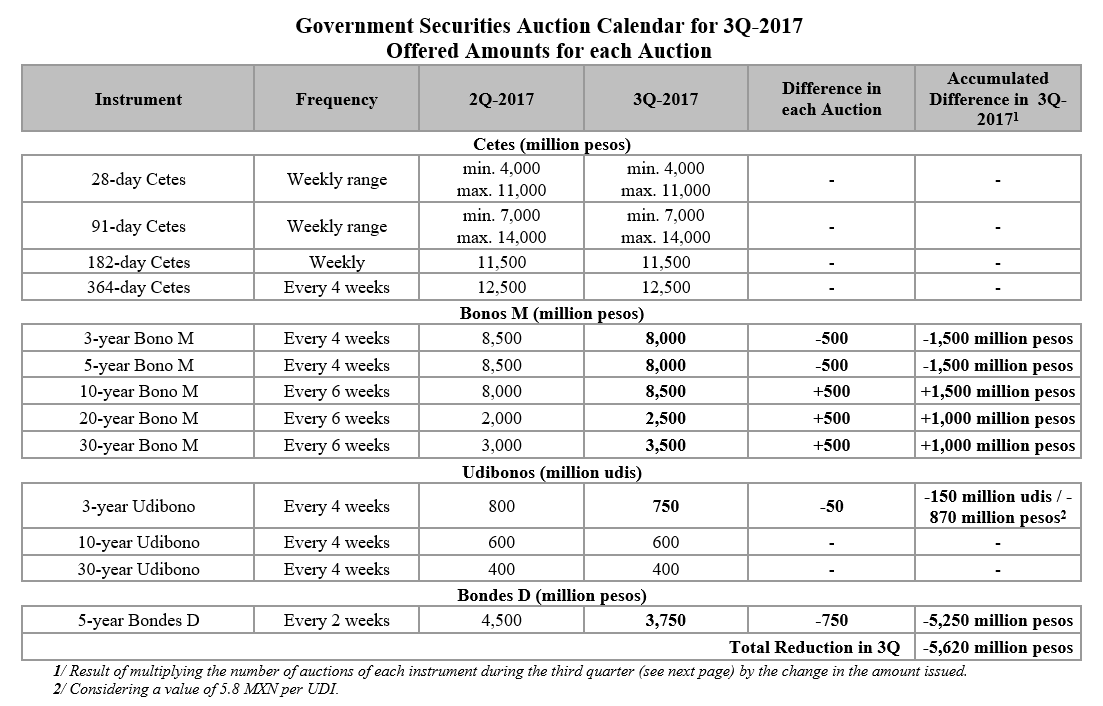

The government securities auction calendar for the third quarter of 2017 considers the following:

- An increase in the demand for Mexican assets during the first half of 2017. There has been a higher demand for longer duration securities in the local debt market, both by local and foreign investors.

- Use of the 70% of the Central Bank’s Operating Surplus (CBOS) aimed at reducing indebtedness of the Federal Government in 2017.

Thus, the MoF considers convenient to adjust the securities auction calendar for the third quarter by using the flexibility of the public debt strategy.

The most important aspects of the Government Securities Auction Calendar for the third quarter of 2017 are the following:

Treasury Bills (Cetes)

- The ranges for the amounts of 28 and 91-day Cetes will remain unchanged. The specific amounts to be auctioned of 28 and 91-day Cetes will be released in the corresponding auction announcements through the Central Bank. The MoF plans to use, with a higher frequency, the flexibility within the range announced for each security in order to address changes arising from the seasonality of the treasury’s cash flow.

- The 28-day Cetes will have a minimum of 4,000 and a maximum of 11,000 million pesos. The first auction of the quarter will be for an amount of 7,000 million pesos.

- The 91-day Cetes will have a minimum of 7,000 and a maximum of 14,000 million pesos. The first auction of the quarter will be for an amount of 11,000 million pesos.

- The amount to be issued for 182-day Cetes will remain unchanged at 11,500 million pesos from the previous quarter.

- The amount to be issued for 364-day Cetes will remain unchanged from at 12,500 million pesos the previous quarter.

Fixed Rate Bonds (Bonos M)

- The amount to be issued for 3-year Bonos M will be decreased from 8,500 to 8,000 million pesos in each auction.

- The amount to be issued for 5-year Bonos M will be decreased from 8,500 to 8,000 million pesos in each auction.

- The amount to be issued for 10-year Bonos M will be increased from 8,000 to 8,500 million pesos in each auction.

- The amount to be issued for 20-year Bonos M will be increased from 2,000 to 2,500 million pesos in each auction.

- The amount to be issued for 30-year Bonos M will be increased from 3,000 to 3,500 million pesos in each auction.

Inflation Linked Bonds (Udibonos)

- The amount to be issued for 3-year Udibonos will be decreased from 800 to 750 million udis in each auction.

- The amounts to be issued for 10 and 30-year Udibonos will remain unchanged at 600 and 400 million udis in each auction, respectively.

- The MoF will be able to carry out stripped Udibonos auctions whenever it perceives the adequate demand from investors to acquire these type of securities. In such case, the amount to be auctioned would be released in the corresponding announcement.

Floating Rate Notes (Bondes D)

- The amount to be issued for 5-year Bondes D will be decreased from 4,500 to 3,750 million pesos in each auction.

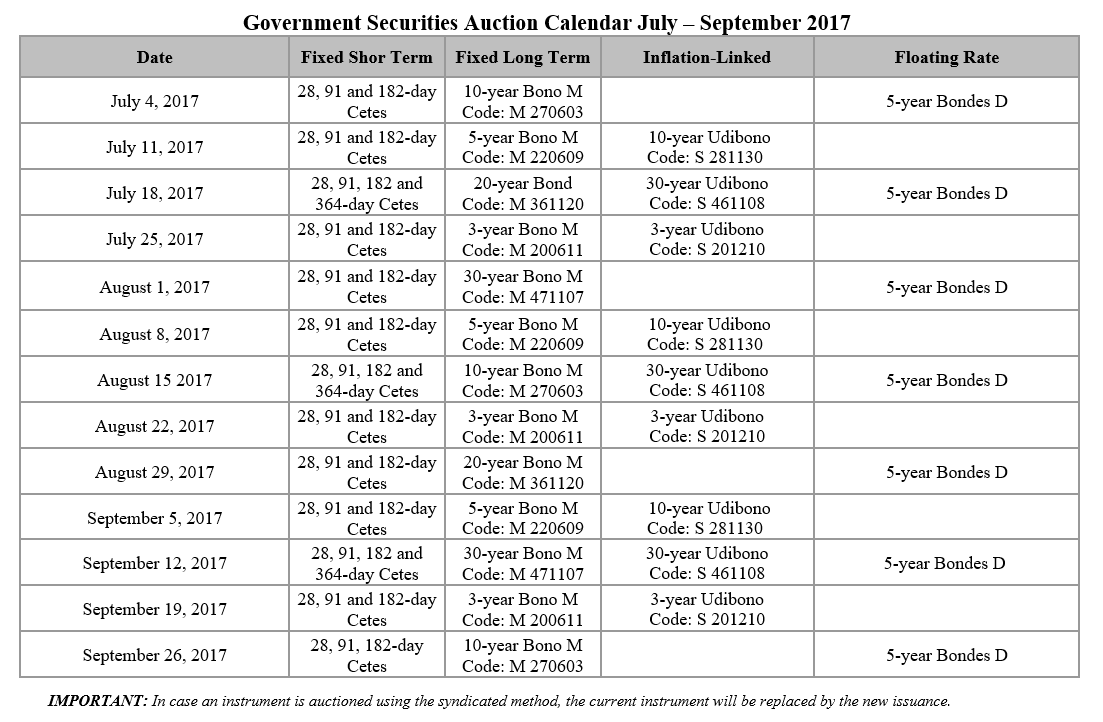

The auctions of Cetes, Bonos M, Udibonos and Bondes D to be executed during the third quarter will have the following characteristics:

Syndicated Auctions

- In the ABP for 2017, the MoF mentioned that it would maintain flexibility to carry out syndicated auctions for new benchmark securities when demand for these type of transactions is perceived. In particular, the MoF mentioned three possible syndicated auctions:

- 5-year Bono M

- 30-year Bono M

- 10-year Udibono

- In the first half of the year, syndicated auctions were carried out for the new 30-year Bono M and the 10-year Udibono benchmarks.

- During the third quarter, the MoF will continue analyzing market conditions to evaluate whether or not to auction the new 5-year Bono M benchmark. In such case, the amount to be issued through the syndicated auction would be in addition to the amounts announced in the quarterly auction calendar.

Liability Management Transactions: Exchanges and/or Repurchases

- In the ABP for 2017, the financing strategy for 2017 considers the execution of exchange and/or repurchase transactions of government securities in order to improve the maturity profile and increase the efficiency of the Federal Government's debt portfolio.

- In this regard, the MoF stated that it would carry out at least one exchange and/or repurchase transaction per quarter, as long as prevailing markets conditions are adequate.

- During 2017, the MoF carried out two exchange transactions in order to improve the maturity profile of the Federal Government, as well as six additional exchange transactions to improve the efficiency of the Federal Government's debt portfolio through a better price discovery process across the yield curve and to strengthen new benchmark securities.

- During the third quarter, the MoF will look for windows of opportunities to carry out exchange and/or repurchase transactions of government securities to continue improving its maturity profile and the efficiency of its debt portfolio.

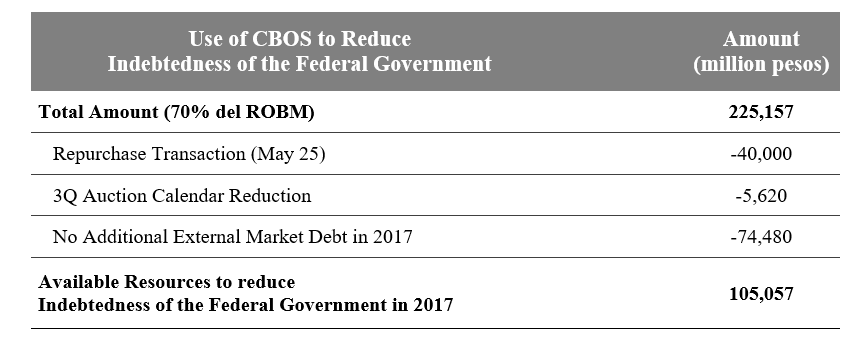

Adjustments to the Auction Calendar for the Third Quarter of 2017 and Use of CBOS

- On March 28, 2017, the Federal Government received 321,653.3 million pesos corresponding to the Central Bank Operating Surplus for the fiscal year 2016, of which 70%, equivalent to 225,157 million pesos, must be used to reduce indebtedness of the Federal Government.

- As mentioned in the press release detailing the progress of the use of the CBOS, the resources used so far for reducing indebtedness are the following:[2]

The Federal Government will continue to inform in a timely manner the details of the transactions in which the resources of the CBOS are used. Additionally, it reiterates its commitment to use public debt in a responsible manner and in accordance with the public debt policy objectives in order to achieve healthy public finances, a necessary element for economic growth.

[1] Annual Borrowing Plan for 2017,