The auction calendar is part of the public debt policy for 2017, which is consistent both with the multi-year fiscal consolidation strategy and the Economic Program approved by Congress for the fiscal year of 2017, as well as with the Annual Borrowing Plan for the same year.

In this context, public debt policy for 2017 is designed to strengthen macroeconomic fundamentals through an efficient management of the public debt portfolio. In this regard, three points stand out:

- Consistent with the fiscal consolidation strategy, policy seeks to meet the Federal Government's financing needs at reduced costs, within a long-term horizon and a low level of risk.

- The program is planned to cover financing needs primarily through local debt markets. Additionally, considering that foreign currency refinancing needs for 2017 have already been covered, international markets will be accessed only if favorable conditions are found.

- Actions regarding public debt management are oriented toward improving the efficiency of Federal Government’s debt portfolio. In this respect, the Ministry of Finance will seek to carry out liability management transactions on a regular basis in order to improve its maturity profile and adapt the portfolio to prevailing market conditions.

In summary, the Federal Government's public debt policy will follow a proactive and flexible strategy in 2017 to contribute to the strengthening of public finances and consequently to Mexico’s macroeconomic fundamentals.

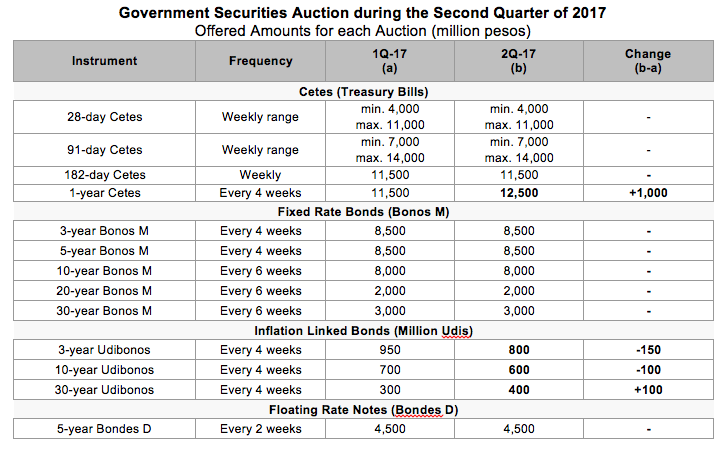

The most important aspects of the Government Securities Auction Calendar for the second quarter of 2017 are the following:

Treasury Bills (Cetes)

- The ranges for the amounts of 28 and 91-day Cetes will remain unchanged. The specific amounts to be auctioned of 28 and 91-day Cetes will be released in the corresponding auction announcement through the Central Bank. As in the previous quarter, it is planned to use with a higher frequency the flexibility within the range announced for each security in order to address changes arising from the seasonality of the treasury’s cash flow.

- The weekly minimum and maximum amount to be auctioned for 28-day Cetes will remain at 4,000 and 11,000 million pesos, respectively. 7,000 million pesos will be auctioned in the first week of the quarter.

- The weekly minimum and maximum amount to be auctioned for 91-day Cetes will remain at 7,000 and 14,000 million pesos, respectively. 11,000 million pesos will be auctioned in the first week of the quarter.

- The amount to be issued for 182-day Cetes will remain unchanged from the previous quarter.

- The amount to be issued for 364-day Cetes will be increased from 11,500 to 12,500 million pesos in each auction.

Fixed Rate Bonds (Bonos M) and Floating Rate Notes (Bondes D)

- The amounts to be issued for all maturities regarding Bonos M and Bondes D will remain unchanged from the previous quarter.

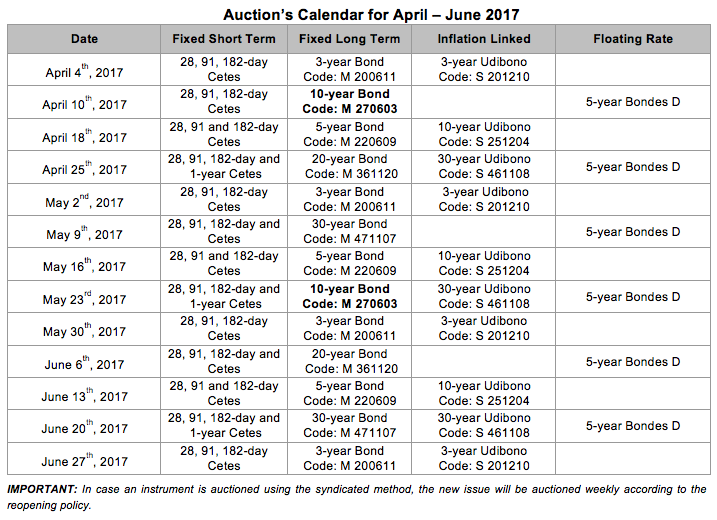

- Starting on the second quarter of 2017, the 10-year benchmark securities for Bonos M to be auctioned will be changed from the ones maturing on march 2026 (M 260305) to those maturing in june 2027 (M 270603).

Inflation Linked Bonds (Udibonos)

- The amounts to be issued for 3-year Udibonos will be decreased from 950 to 800 million udis in each auction.

- The amounts to be issued for 10-year Udibonos will be decreased from 700 to 600 million udis in each auction.

- The amounts to be issued for 30-year Udibonos will be increased from 300 to 400 million udis in each auction.

- The Ministry of Finance will be able to carry out auctions of stripped Udibonos whenever it perceives the adequate demand from investors to acquire these securities. The amounts to be auctioned will be released in the corresponding announcement.

The auctions of Treasury Bills, Fixed Rate Bonds, Udibonos and Floating Rate Notes to be executed during the first quarter will have the following characteristics:

Other Transactions

Syndicated Auctions

- As announced in previous quarters, syndicated auctions will remain under a flexible format. This format allows the SHCP to choose the right timing for each transaction based on investors’ appetite as well as market conditions. These auctions are not part of the amounts announced for the quarterly calendars nor as substitutes of primary auctions. Once the new references are issued, the reopening policy will continue.

Liability Management Transactions: Exchanges and/or Repurchases

- The Ministry of Finance will seek for opportunities in the financial markets that allow the exchange and/or repurchase transactions of government securities during the second quarter of 2017 in order to keep improving Federal Government’s maturity profile, as well as to increase the efficiency of its debt portfolio. These transactions may involve all the different instruments that are issued.

In case the Ministry of Finance decides to execute any of the transactions mentioned, it will announce it through the Central Bank. This announcement will include the type of securities, amounts, as well as the maturity of the issues involved in the transactions.

Central Bank’s Operating Surplus

- On March 28th, 2017, the Central Bank transferred 321,653.3 million pesos, approximately 1.5% of GDP, to the Federal Government regarding the operating surplus that corresponds to the 2016 fiscal year.

- In compliance with the Budget and Fiscal Responsibility Federal Law (LFPRH), the Federal Government will use the resources as follows: i) at least seventy percent to amortize public debt acquired in previous fiscal years or to reduce financing needs required to cover the budget deficit of the current year, or any combination of both; ii) the remainder to strengthen the Budgetary Income Stabilization Fund (FEIP) or to increase assets intended to improve the Federal Government's financial position.

- Taking into account that conditions in both international and local financial markets may change in the face of uncertainty prevailing in the global economy, the Federal Government will consider all the tools at its disposal to choose those that allow it to use the operating surplus in order to continue increasing the efficiency of the debt portfolio, furthermore improving both its maturity profile and financial position.

- Finally, it is worth mentioning that resources from the operating surplus and its usage will be reflected as an additional improvement in the Public Sector Borrowing Requirements (PSBR) and the Historical Balance of the Public Sector Borrowing Requirements (HBPSBR) corresponding to the 2017 fiscal year, therefore accelerating the fiscal consolidation plan.